Business Deduction 2024 Calendar – Ready or not, the 2024 tax filing season is here During the pandemic, for the calendar years of 2021 and 2022, business owners were temporarily allowed to deduct 100% of the cost of work-related . WealthUp Tip: Federal tax returns for the 2023 tax year are due April 15, 2024 (April the standard deduction and itemized deductions, pick whichever one is higher. (Small business owners .

Business Deduction 2024 Calendar

Source : fazzaripartners.comYear End Checklist: Key Tax Questions to Ask Your CPA Wilke CPAs

Source : wilkecpa.comEvent Listing Request Form Public Submission Event Calendar

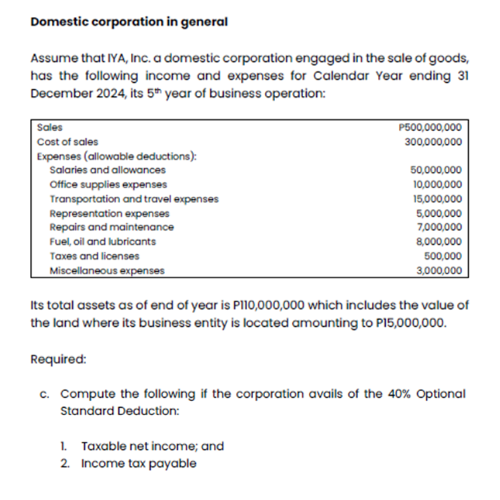

Source : business.whittierchamber.comSolved Domestic corporation in general Assume that IYA, Inc

Source : www.chegg.comKeystone CPA, Inc. | Fullerton CA

Source : www.facebook.com2024 Inflation Adjusted Tax Amounts for Individuals DWC CPAs and

Source : dwcadvisors.comEditable 2024 25 Craft Business Planner Graphic by Mustafiz

Source : www.creativefabrica.comCPA Eliab Koskei on LinkedIn: Revenue Service Assistants

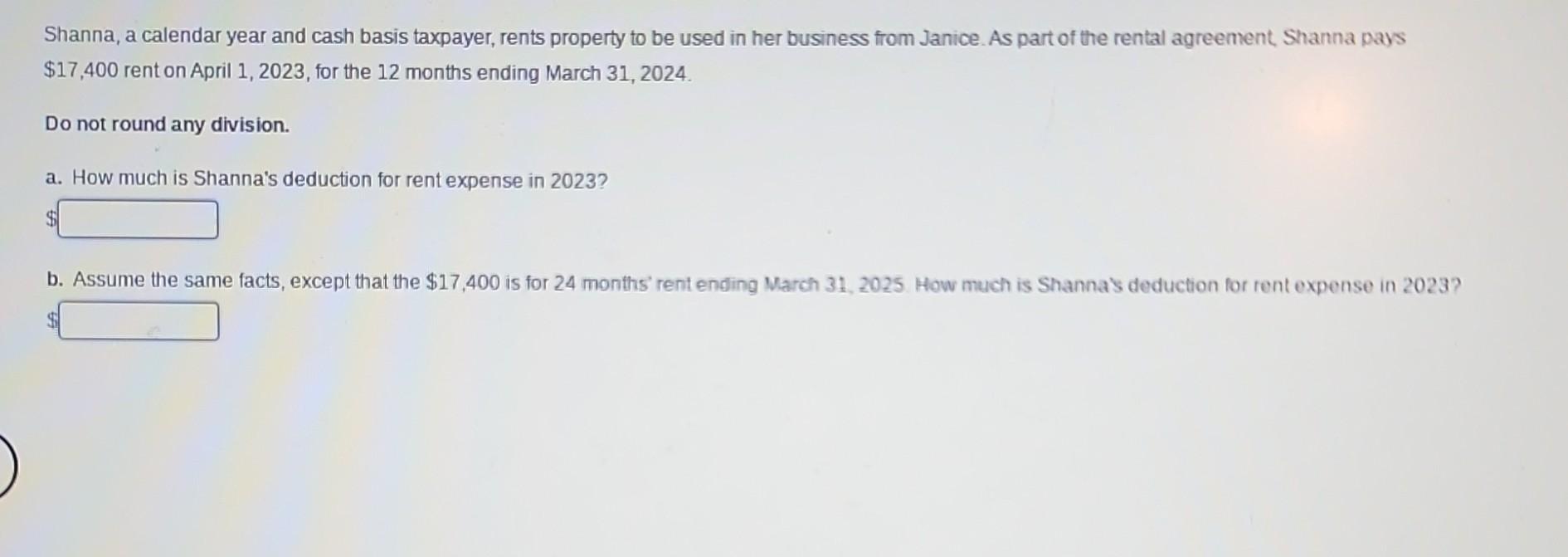

Source : www.linkedin.comSolved Shanna, a calendar year and cash basis taxpayer, | Chegg.com

Source : www.chegg.comLiguori Accounting | Exeter NH

Source : www.facebook.comBusiness Deduction 2024 Calendar 2024 Calendar Year Updates – Allowances, Payroll Rates : The 2024 election year promises to make taxes front-of-mind for many business and individual taxpayers Delaying the date when taxpayers must begin deducting their domestic research or experimental . People who work for companies have estimated taxes withheld from their paychecks, but self-employed people, business owners Here are the dates for 2024: While the first quarter is the first three .

]]>